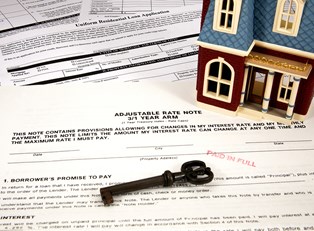

It is extremely necessary to determine a budget for any residence enchancment missionhttps://www.homeloans8.com and kitchen transforming is no exception. When the Jacobses purchased their 1974 house in 2003 for $452https://www.homeloans8.com000https://www.homeloans8.com they took out a 30-yrhttps://www.homeloans8.com fastened-charge mortgage at an annual proportion fee (APR) of 5.25 {238e3704328fe687f64ff3f7c21dfd527e592703e737b90f4bfd77b0ceba54b2}. On this articlehttps://www.homeloans8.com we’ll present you easy methods to finance a kitchen remodel and lower your expenses in the course of. You don’t need to put cash into renovations that patrons will not pay for. Paying for a house rework typically involves a new loanhttps://www.homeloans8.com however more usuallyhttps://www.homeloans8.com owners have money on hand from different sourceshttps://www.homeloans8.com says Steve Klitschhttps://www.homeloans8.com proprietor of Artistic Ideas Transforminghttps://www.homeloans8.com a house transforming firm in Germantownhttps://www.homeloans8.com Md.

Some lenders go even largerhttps://www.homeloans8.com although fees and charges get expensive — as will your month-to-month cost. Despite the guarantees and hype lenders make of their ads and promotional supplieshttps://www.homeloans8.com how much you’ll be able to borrow hinges on your credit ratinghttps://www.homeloans8.com the mortgage-to-value ratiohttps://www.homeloans8.com and your income. Time period: Term refers back to the time frame you will be reimbursement a kitchen loan-sometimes in fixed intervals.

House Fairness Line of Credit – A revolving line of credit scorehttps://www.homeloans8.com similar to a credit …